We customize a package that is specific to you and your employees.

Let’s Talk

Email or Call:

CALL: 310.546.4295

EMAIL: JMichaud@JaniceMichaud.com

Individual & Family Plans

Interested in comparing individual coverage to group coverage? Use the individual and family quoting platform below.

Group Coverage Quote

Download and complete the Group Request Form

Fax or email for quote:

FAX: 1 866 576-5605

EMAIL: JMichaud@JaniceMichaud.com

UP TO THE MINUTE ACTIONABLE INFO

Depending on your particular circumstances and your present health plan the urgency for action and what action you should take vary.

Here’s some guidance:

If you are a Small business employer with a current group plan:

You may be looking to see what your options are. I will be happy to bring you up to date with the changes that have happened in the last year and what options are available to save costs for you and your employees. Let’s answer all those questions that have you confused and frustrated. Let’s form our partnership. Let’s talk…

If you have an Individual/Family Plan (IFP):

We’ll look at the of you and/or your employees qualifying for subsidies in on the Covered CA Exchange. We can look at it closely to see what the bigger picture is for you and your business.

We’ll examine the subtleties of group insurance and weigh your options thoroughly.

If your plan is “Grandfathered”:

A “grandfathered plan” refers to a plan that was issued prior to when the ACA was first signed on March 23, 2010. If your plan is grandfathered you may be able to keep it. Some plans retain value because they did not have to absorb all the mandated coverages. We should first find out if your GF plan will be allowed or available in 2020. You should thoroughly compare before you give this plan up. If you have qualified family or dependents they most likely can still join you on this policy or vice versa. And again, we will compare to IFP on and off exchange and small group if your eligible.

If you’re a employer and have decided not to offer group insurance in 2020:

Consider providing a defined contribution that your employees could use to purchase their own insurance, and you both could still realize tax benefits.

We can help you weigh your options, and get signed to the best one for you.

Please contact Janice Michaud or call 310-546-4295

CHANGES IN HEALTH COVERAGE IN CALIFORNIA 2020

The Patient Protection and Affordable Care Act is the federal law passed in 2010 to provide affordable health insurance to more Americans. This law can change the way health insurance companies provide coverage as well as the way consumers purchase their healthcare plans. With the new Affordable Care Act, group insurance may no longer be the right choice for you… Or you may benefit from Exchanges. Let’s talk about the right approach for YOU and your situation.

Healthcare Insurance FAQs

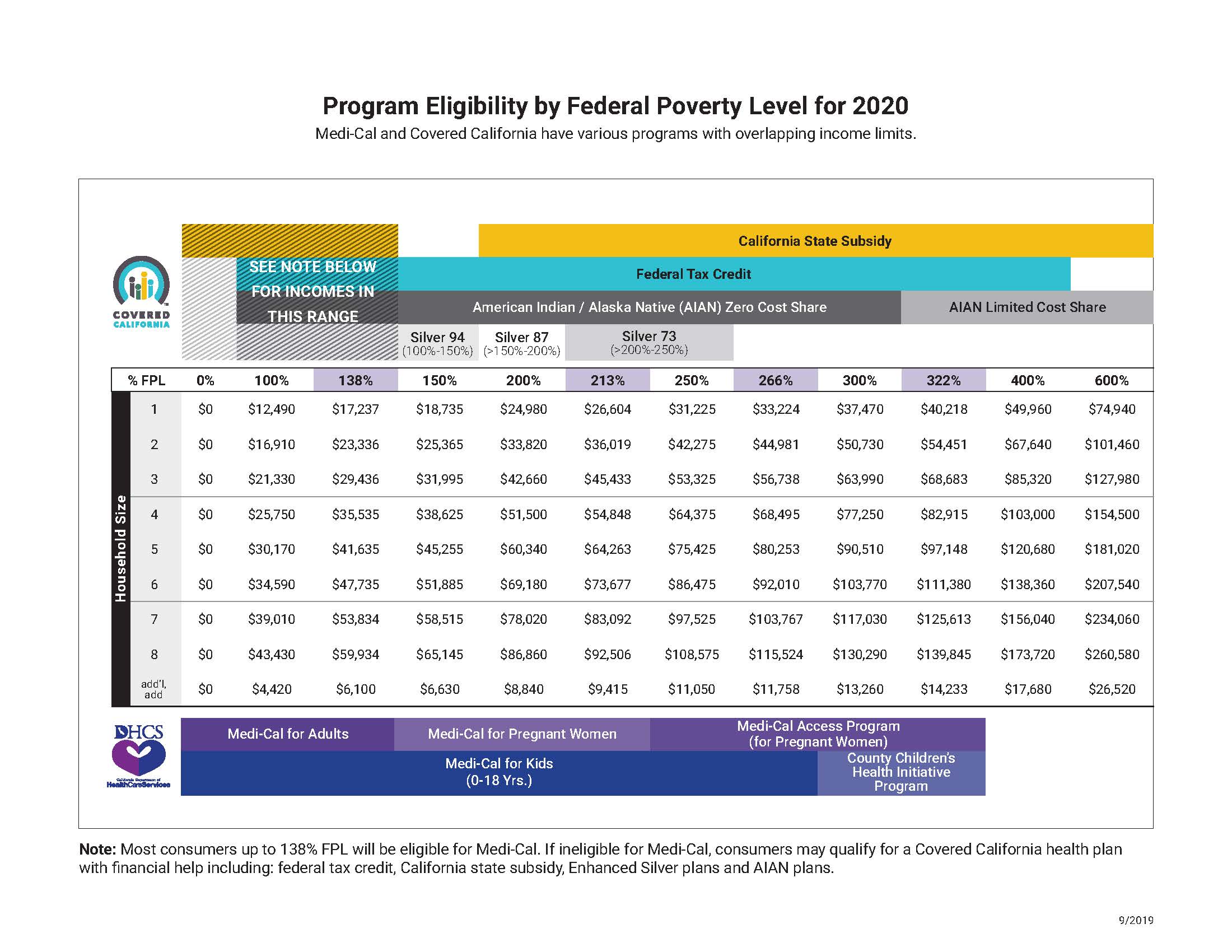

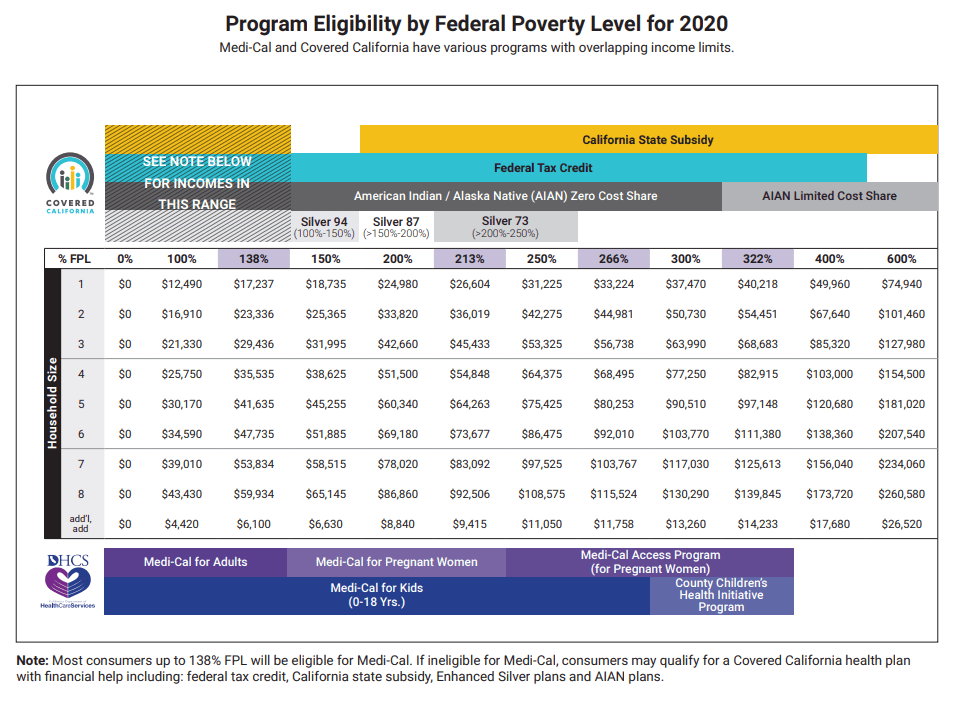

The PPACA Act established state marketplaces; California’s marketplace is called Covered California™ and sometimes offers more affordable options with financial support through:

- Federal Tax Credits

- State Tax Credits

- Cost-sharing subsidies

- Medi-Cal assistance

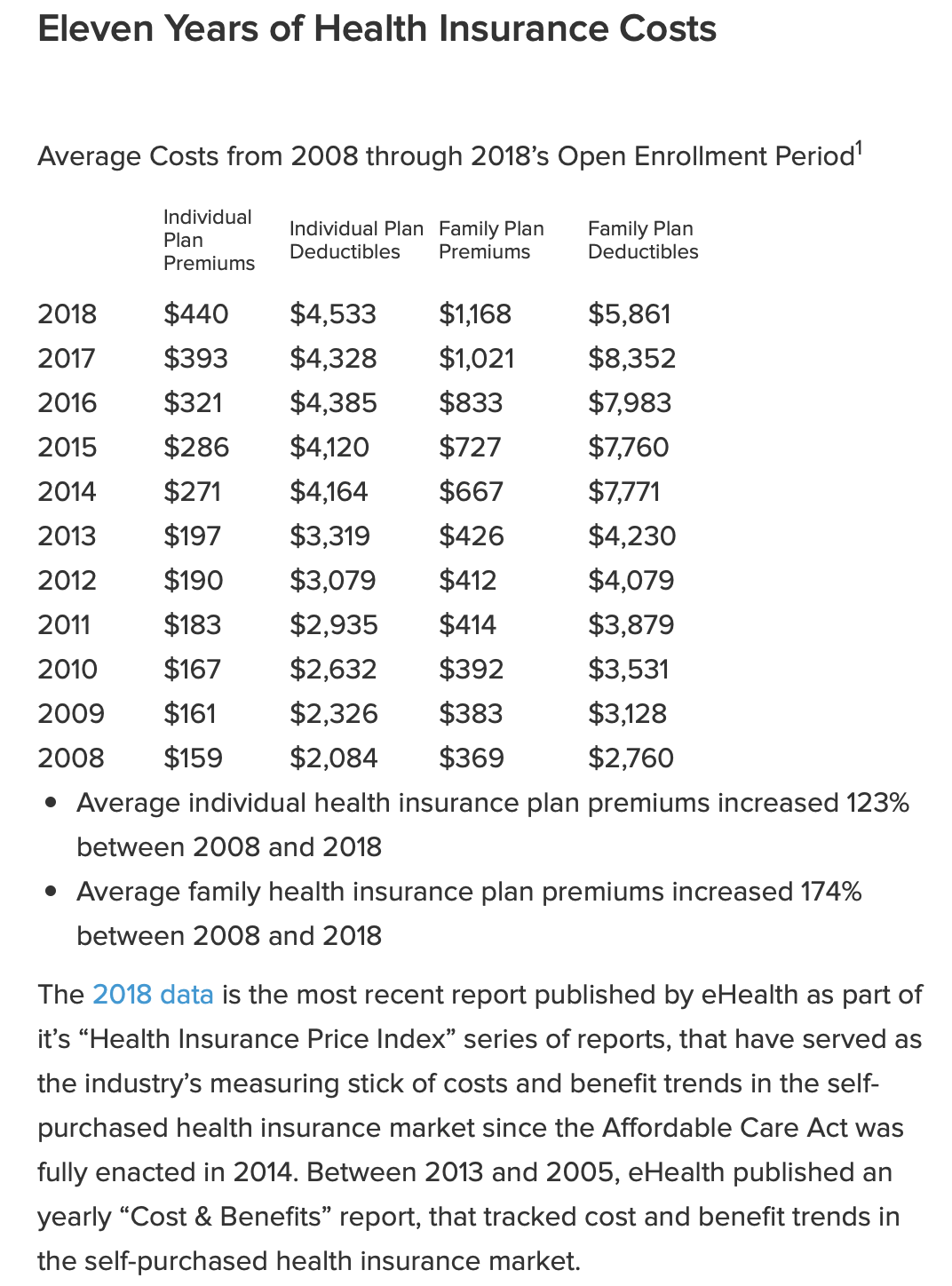

Recent and changes and trends may catch you by suprise.

- In all states coverage was not mandated for 2019, no worry regarding penalties

- In CA coverage will be mandated in 2020 CA, penalties apply

- Temporary policies are not available in CA

- CA legislature has banned coverage alternatives

- Covered Ca is requesting proof of identity requiring an ACA Certified specialist

Today, more than ever, consumers need the help of specialists to help explain and put inplace their options. We can ensure you are well informed, have access to the best healthcare you can afford, and that you don’t end up overpaying and over or under insured. Use your resources wisely… Know what you’re doing … Do the right thing.

In 2020, you will have seven “basic health plan choices”, though the considerations have become even more complex:

- Individual and Family

- Small Group

- Large GrouP

- Medicare

- Medi-Cal

- COBRA

In addition, you will have the choice of “buying on the exchange” or “buying off the exchange.”

Eligibility and the degree of subsidy is based on a standard called the “federal poverty level” (FPL).

Show and Compare health coverage programs at Covered California

You can use the calculator to see what the cost of your insurance will likely be here.

- Tax Savings: Employer and Employee do not pay taxes on the reimbursements.

- Happier Employees: Employees value health benefits at up to 2Xs taxable compensation.

- Healthier Employees: When employees have health insurance they tend to be healthier.

- Employees can buy plans in or out of the exchange and some will be eligible for subsidies.

- Employers can define their contribution and don’t have to administer a health plan

- Easy and less time to administer.

Employers, business owners, employees, families, and parents:

Know what you’re doing… Do the right thing…. Use your resources wisely.

*Every need is unique. These are general estimates and not a final quote. Please contact Janice at (310) 546-4295 or via email for detailed and accurate information.